News

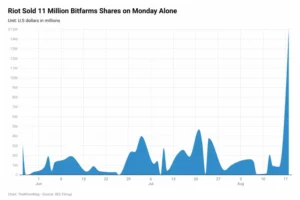

Riot Offloads 11M Bitfarms Shares in One Day, Slips Below 5% Ownership

“Bitcoin Mining Faces an ‘Incredibly Difficult’ Market as Power Becomes the Real Currency.” CoinDesk’s headline from this week felt almost self-evident to anyone following the sector. Yet hearing mining executives themselves lay it out so plainly at the SALT conference in Jackson Hole added another layer of clarity — and candor — about where the industry is heading.

CleanSpark CEO Matt Schultz captured the shift: “We used to come here and talk about hash rate. Now we’re talking about how to monetize megawatts.” With 800 MW in operation and 1.2 GW in development, CleanSpark has been racing to lock up stranded energy across the U.S., using its growing scale to expand beyond bitcoin into grid services.

Terawulf’s CFO, Patrick Fleury was equally blunt, saying that even at today’s prices, half of a miner’s revenue can be swallowed by electricity. With Bitmain continuing to push hash power into the market regardless of demand, he argued that only those with ultra-cheap power — or the ability to redeploy infrastructure into new businesses — will survive. Terawulf’s $6.7 billion deal with Google to convert mining sites into data centers is one such pivot.

Indeed, after the 2022 bear market, Bitmain was sitting on more than 50 EH/s worth of excess S19 XP inventory, which it shipped to the U.S. for self-mining when buyer demand dried up. The reality is that Bitmain also has little flexibility to sharply cut or suspend wafer orders with TSMC when the cycle turns down. To do so would risk losing its foundry allocation — and the ability to ramp production again when the bull market returns. As a result, Bitmain keeps producing hardware regardless of demand, either selling or deploying it itself, which pushes global hashrate higher and tightens margins for everyone else.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

IREN offered a counterpoint: with 50 EH/s online, the company says it is generating a billion-dollar revenue run rate with healthy margins. Still, even IREN is channeling more capital into GPUs. This week, it doubled its Blackwell B200 fleet with a $193 million order, supported by $102 million in lease financing, just days after settling a bruising three-year legal fight with NYDIG over $105 million in defaulted loans. Its Prince George campus in Canada could eventually host 20,000 Blackwell GPUs, underscoring how even profitable miners are chasing diversification.

MARA also emphasized balance sheet strength and agility, with CFO Salman Khan likening mining’s volatility to oil’s boom-and-bust cycles. MARA has leaned on its bitcoin treasury as a hedge and is now expanding into sovereign and edge compute through its majority stake in Exaion.

Meanwhile, Hut 8 unveiled plans for four new U.S. sites totaling 1.53 GW. Backed by a new $200 million revolving credit line with Two Prime, a $130 million repriced facility with Coinbase, and a $1 billion ATM program, Hut 8 now claims a pipeline of more than 10 GW in development. The company holds over 10,000 BTC worth $1.2 billion as collateral strength, but stopped short of offering any construction timeline for the latest projects.

Taken together, the week’s news reiterates the common truth: bitcoin remains the anchor, but energy is the new yardstick. Whether through mining, data centers, GPUs, or grid services, miners are being forced to treat megawatts as the real currency — and to speak with unusual frankness about just how difficult the business has become.

Hardware and Infrastructure News

HIVE Digital Technologies Crosses 16 EH/s - Link

IREN Doubles GPU Fleet With $193M Blackwell Purchase to Accelerate AI Pivot - TheMinerMag

Corporate News

NYDIG, IREN Reach Confidential Settlement After Failed Appeal and Looming Examination - TheMinerMag

Greenidge Generation Announces Termination of Agreement to Sell South Carolina Property - Link

Greenidge Generation Announces Commencement of Cash Tender Offer and Exchange Offer for Senior Notes Due 2026 - Link

MARA Appoints GM of Europe in Paris to Advance Global Expansion - Link

Financial News

Bitcoin Miner Hut 8 Launches New $1 Billion At-the-Market Offering - TheMinerMag

Hut 8 Secures $330M Credit from Two Prime, Coinbase to Back 1.5 GW U.S. Expansion - TheMinerMag

Gryphon Stock Jumps 10% on News Report of American Bitcoin Merger Approval - TheMinerMag

Feature

Bitcoin Mining Faces 'Incredibly Difficult' Market as Power Becomes the Real Currency - CoinDesk

Over the past week, the most consequential news in the bitcoin mining world had little to do with mining itself. Instead, it revolved around high-performance computing (HPC) and artificial intelligence. A series of announcements underscored just how aggressively miners are chasing HPC opportunities—from financing and partnerships to board appointments and investor interest.

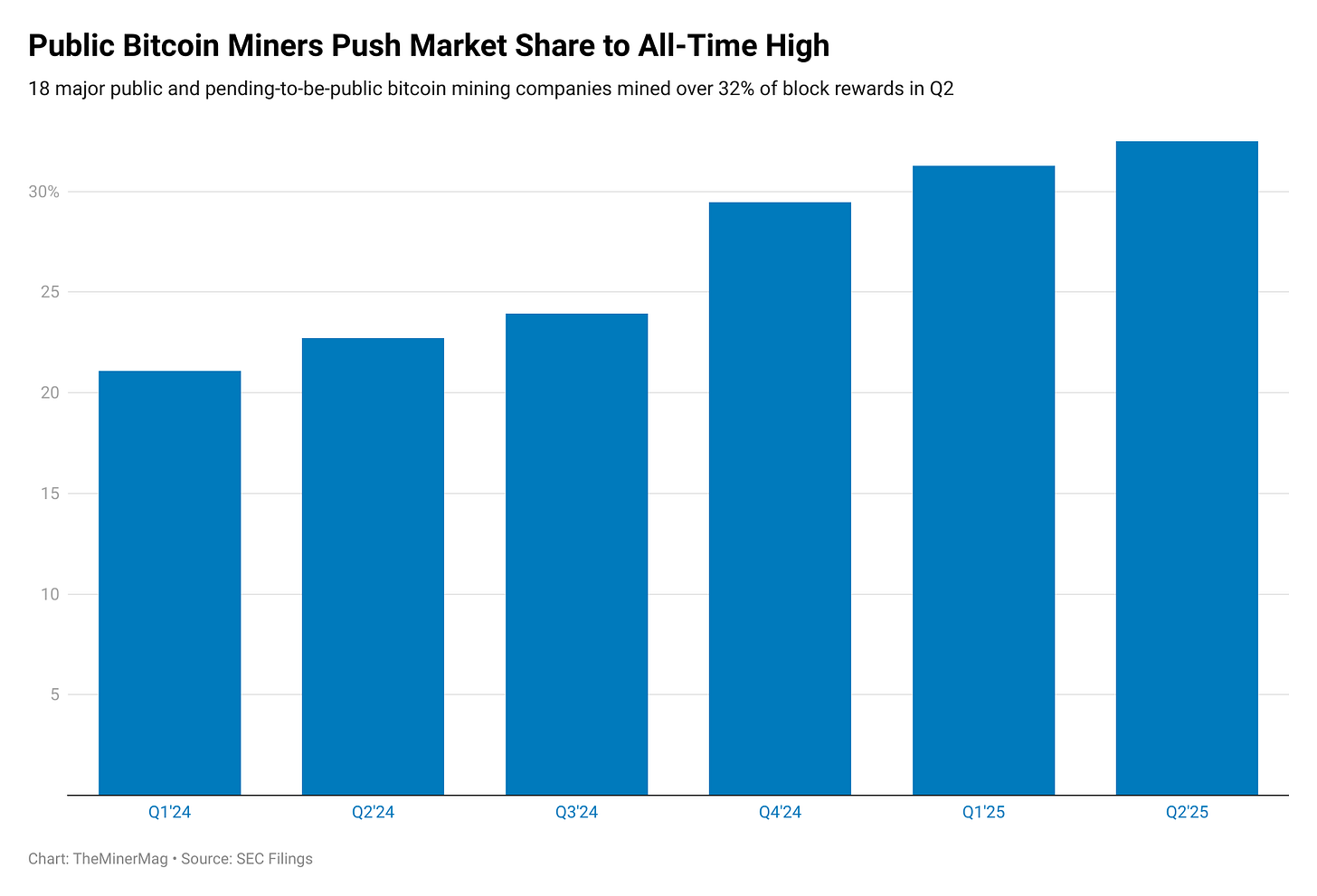

At the same time, newly reported Q2 production numbers reveal that public and soon-to-be-public miners are also quietly consolidating their share of bitcoin output. The combined market share of 18 companies increased to 32.5% in Q2, up from 21.1% the same period last year.

At first glance, this appears to be a story of public miners tightening their grip on the network while simultaneously exploring new frontiers in compute. But beneath the surface, the gains are uneven. The rise in combined market share was not broad-based; rather, it was driven primarily by MARA, Cango, IRE and CleanSpark, who substantially expanded their hashrate and offset losses from miners that pivoted to HPC or stalled growth.

Winners and pivoters

This uneven trajectory reflects a sector moving on diverging paths:

Scale-up leaders like MARA, Cango, and CleanSpark are doubling down on bitcoin mining capacity, capturing the market share vacated by peers.

Pivoters such as Bitfarms and TeraWulf are allocating more capital to HPC hosting and partnerships, slowing their mining growth.

Dual-track players such as Core Scientific and HIVE are trying to balance both—expanding mining operations while also investing in AI infrastructure.

Core Scientific offers a striking example of this dual approach. Last week it helped debut Block’s Proto rig, part of a purchase agreement expected to deliver 15 EH/s to its fleet. It remains to be seen, though, whether the pending CoreWeave acquisition would cut the mining segment. On the treasury side, Core appears to have hodled all its mined bitcoin so far in 2025, reporting $172.8 million in digital assets (about 1,611 BTC) as of June 30—suggesting no sales since January.

HIVE, meanwhile, is pushing ahead on two fronts. In the second quarter, it signed a deal with Bitmain to expand its bitcoin mining capacity by 3.5 EH/s, pledging BTC for payments with the option to repurchase the coins to retain upside exposure. At the same time, the company is supplying GPU compute power to Bell Canada’s “AI Fabric,” billed as the country’s largest sovereign AI cloud initiative.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

The HPC wave: last week’s highlights

While market share dynamics show where miners stand in bitcoin, the week’s headlines highlighted just how aggressively they are repositioning for HPC:

Galaxy’s Helios reboot – Galaxy Digital secured a loan priced at more than 9% interest to fund the conversion of its Texas Helios site into one of the world’s largest AI campuses. Read more

TeraWulf expands with FluidStack – TeraWulf deepened its partnership with FluidStack to scale AI/HPC hosting. Share surged 50%. Read more

Bitfarms adds cloud experience – The company appointed former AWS executive Wayne Duso to its board, signaling intent to strengthen HPC strategy. Read more

HIVE and Canada’s sovereign AI push – HIVE will supply GPU compute for Bell Canada’s “AI Fabric,” a sovereign AI cloud initiative. Read more

TeraWulf raises $850M – The company upsized its convertible note offering to fund HPC infrastructure growth. Read more

Situational Awareness bets on Core – The AI-focused investment fund led by 23-year-old AI influencer and former OpenAI researcher Leopold Aschenbrenner disclosed a 5.8% stake in Core Scientific, underscoring investor belief that miners’ power assets make them prime HPC plays. Read more

Other Notable News ICYMI

TeraWulf Shares Jump 50% after Google Secures 8% Stake as part of $3.7 Billion 10-year AI Compute Deal - The Block

Crypto group backed by Trump sons hunts for bitcoin companies in Asia - FT

Compass Mining Energizes 10 MW Bitcoin Mine in Texas with Onmine Partnership - TheMinerMag

Riot Offloads 11M Bitfarms Shares in One Day, Slips Below 5% Ownership - TheMinerMag

Bitdeer Aims to Expand US Rig Manufacturing Amid Trump Tariff Headwinds - Decrypt

Hut 8 breaks ground on artificial intelligence data center in West Feliciana Parish - Louisiana Radio Network

In our previous issue, we broke down how the Trump family-backed American Bitcoin’s (ABTC) 25 EH/s roadmap hinged on an option to buy up to 15 EH/s of on-rack capacity from Bitmain — the Chinese hardware giant now facing heightened tariff scrutiny in the U.S. That plan just moved from option to reality earlier this month.

After Hut 8 energized the Vega site in Texas — the flagship facility expected to host much of American Bitcoin Corp.’s (ABTC) incoming fleet — its proprietary mining subsidiary has moved to execute nearly the full option under its miner procurement deal.

Hut 8 disclosed in its Q2 earnings report that in August, ABTC agreed to purchase 16,299 Antminer U3S21EXPH units from Bitmain, totaling about 14.02 EH/s, for roughly $314 million. The deal marks a decisive step toward ABTC’s stated goal of reaching 25 EH/s.

The purchase forms part of a broader On-Rack Sales and Purchase Agreement with Bitmain Technologies Georgia Limited covering up to 17,280 miners (14.86 EH/s) for as much as $319.5 million, excluding tariffs and other import charges.

ABTC’s August tranche was funded by pledging about 2,234 BTC — valued at a mutually agreed fixed price — alongside applying a $46 million deposit already paid. The pledged Bitcoin carries a 24-month redemption period. The remaining miners under the agreement must be acquired within two months, via cash or additional Bitcoin pledges.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

The move comes just weeks after ABTC accelerated its Bitcoin accumulation program, buying roughly 1,726 BTC between July 1 and August 6 for $205.6 million at an average price of $119,120. Majority-owned by Hut 8, the company now holds a significantly expanded Bitcoin reserve alongside its forthcoming hardware capacity.

The transaction also reflects shifting dynamics in mining hardware sales. Bitmain has been working to scale up U.S.-based manufacturing to mitigate tariff risks — a growing concern as U.S.-listed miners such as IREN and CleanSpark have received U.S. Customs and Border Protection invoices for import duties on rigs CBP claims are of Chinese origin. Both IREN and CleanSpark are contesting those claims, citing supplier documentation to the contrary.

ABTC’s merger prospectus with Gryphon Digital noted that its $320 million Bitmain deal excludes any such potential charges. It remains to be seen whether Bitmain will supply U.S.-made Antminers for ABTC’s order, potentially drawing on previously reported imports of electronic components.

Even with tariffs aside, institutional demand for large-scale hardware orders has slowed as Bitcoin’s network hashrate growth plateaus, intensifying competition for sales. Earlier this month, Bitmain began marketing hosted S21e Hydro hashrate to retail buyers — a move underscoring the cooling pace of institutional purchases despite Bitcoin’s ongoing bull run.

Regulation News

Ethiopia to Wind Down Bitcoin Mining Citing Grid Strain - TheMinerMag

Mountain City leaders nix rezoning for Bitcoin facility - WJHL

Hardware and Infrastructure News

Canaan Exits Kazakhstan and South Texas Sites Amid Bitcoin Mining Fleet Reshuffle - TheMinerMag

Cango Buys 50 MW Georgia Bitcoin Mine for $19.5M in Vertical Integration Push - TheMinerMag

MARA to Acquire Majority Stake in EDF’s HPC Subsidiary Exaion for $168 Million - TheMinerMag

Bitfarms Acquires Land for HPC in US, Exits Argentina Bitcoin Mining Amid Power Supply Halt - TheMinerMag

Soluna Expands Partnership with Galaxy Digital to Deploy 48 MW at Project Kati - Link

Corporate News

Core Scientific's Top Investor to Vote Against CoreWeave's 'Inadequate' $9B Takeover - Decrypt

CleanSpark Faces $185M Tariff Risk Over Bitcoin Miner Imports - TheMinerMag

CleanSpark Chair Matt Schultz Returns as CEO; Bradford Departs With $2.53M, Bitcoin and Equity - TheMinerMag

Financial News

Rumble Mulls €1B Northern Data Takeover as Peak Mining Set for $235M Sale - TheMinerMag

Trump Family-Backed American Bitcoin Boosts BTC Reserves With $205M Purchase - TheMinerMag

For much of the past two years, the public bitcoin mining sector has been defined by one number — deployed hashrate. Companies raced to announce ever-larger fleet expansions, locking in hosting deals, power capacity, and purchase agreements for the latest generation of ASIC miners.

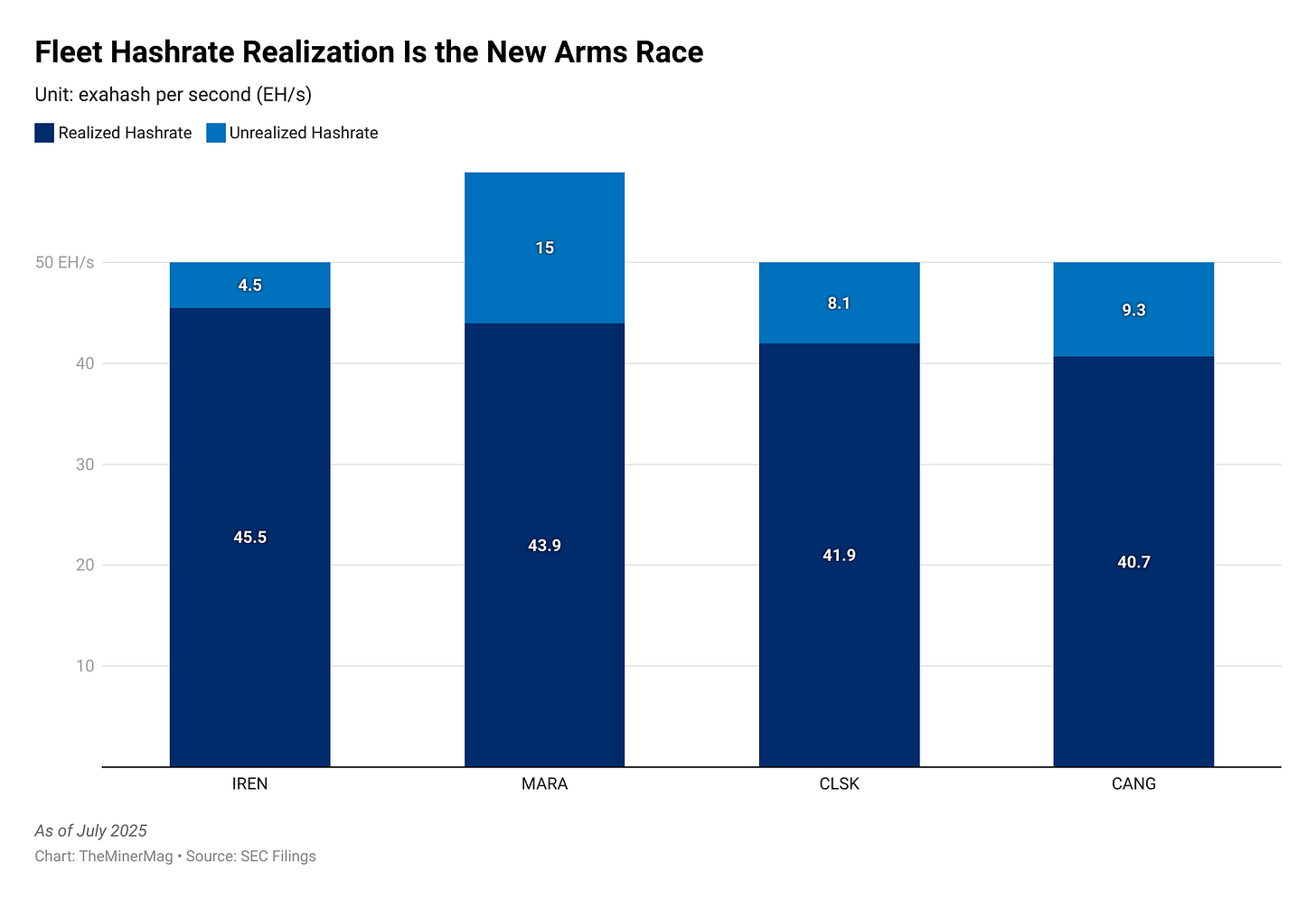

But the July production figures from four of the industry’s largest players — MARA, CleanSpark, Cango and IREN — show that the hashrate expansion war is giving way to a new contest: getting the most out of what you already have.

On paper, the four companies are in the same league. All reported 50 EH/s or more in deployed hashrate last month, with MARA topping the group at 58.9 EH/s, followed by CleanSpark, Cango and IREN each at 50 EH/s. In practice, however, the amount of that capacity actually producing bitcoin — known as realized hashrate — varied.

IREN came out on top, converting its 50 EH/s deployment into an implied realized hashrate of 45.5 EH/s. That was enough to produce more bitcoins in July than MARA, despite MARA’s substantially larger deployed fleet. MARA’s realized capacity came in at 43.9 EH/s, CleanSpark’s at 41.9 EH/s, and Cango’s at 40.7 EH/s.

Cango’s realization rate was hampered by timing — it only completed the acquisition of its additional 18 EH/s to reach 50 EH/s midway through July. Even so, the data underscores a growing performance gap between companies that can keep their machines online and productive, and those that struggle with downtime, curtailment, or deployment delays.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

Despite three of the four realizing less than 90% of their fleets in July, their combined production accounted for 19.07% of all bitcoin block rewards that month — the highest monthly share they’ve ever achieved. With seasonal power curtailments likely to ease after the summer, their combined share could easily break the 20% mark in the coming months. That would mean one in every five bitcoin mined globally comes from just four public companies.

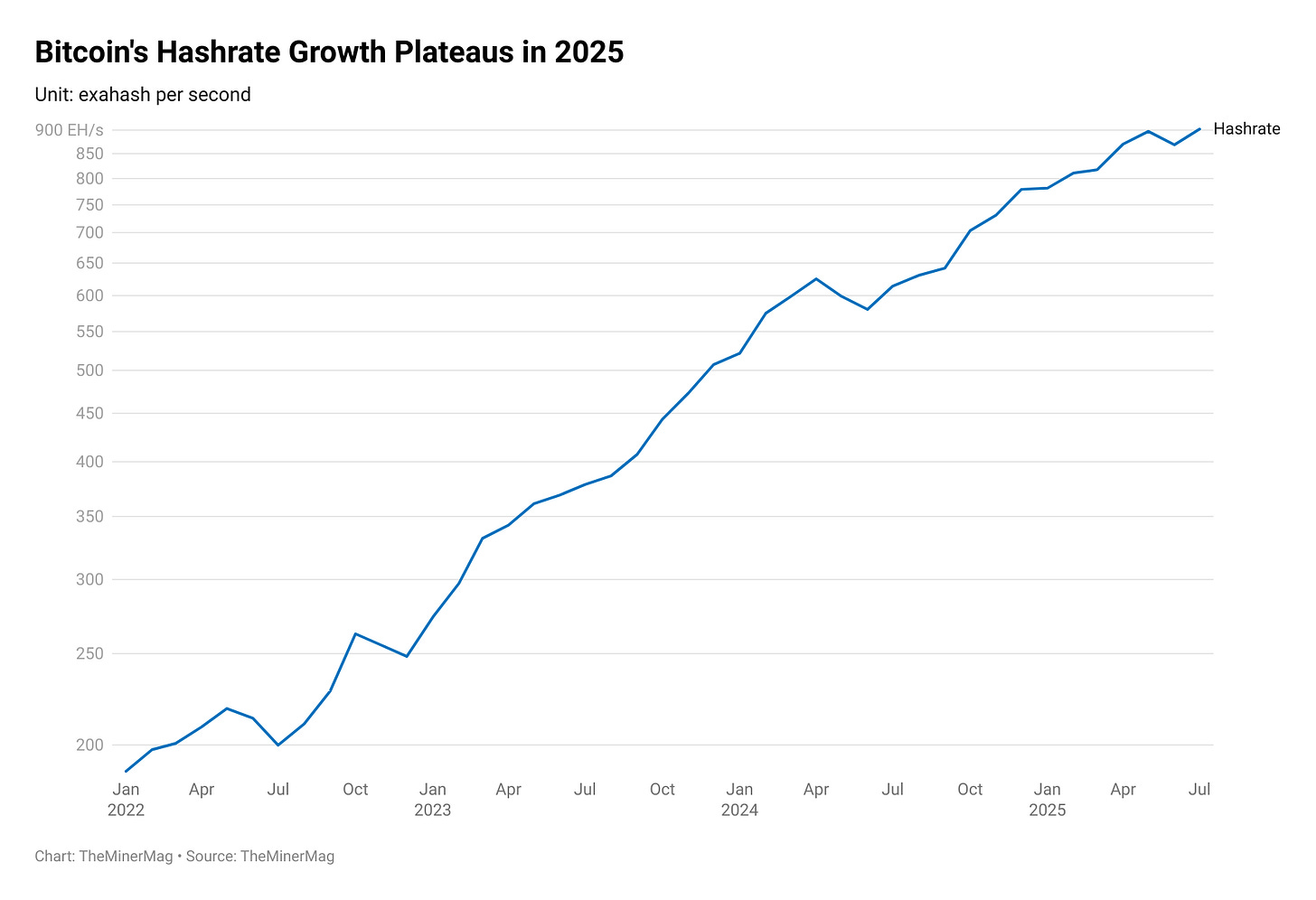

The shift in focus is driven by a changing macro picture for the network itself. Bitcoin’s monthly average hashrate has grown just 15% so far this year, from 780 EH/s in January to 902 EH/s in July. That’s a plateau compared to the explosive growth seen in prior cycles, and a sign that the industry’s collective buildout may be hitting the limits of available power and infrastructure — at least in the short term.

Regulation News

Two California Men Charged With Illegally Exporting AI Chips to China - Decrypt

Hardware and Infrastructure News

Cipher, Cango Boost Bitcoin Mining Output as Network Hashrate Hits New Record - TheMinerMag

IREN Tops MARA in July Bitcoin Production with Record Realized Hashrate - TheMinerMag

Greenidge to Sell Mississippi Bitcoin Mine for $3.9M Amid Ongoing Financial Struggles - TheMinerMag

Corporate News

Trump-Backed American Bitcoin Nears Public Listing as Gryphon Sets Merger Vote Schedule - TheMinerMag

BIT Mining Buys $5M SOL to Launch Validator in Shift From Bitcoin Treasury - TheMinerMag

Bitfarms Announces Partnership with T5 Data Centers to Advance HPC/AI Development at Panther Creek Campus - Link

MARA, Riot Diverge on Bitcoin Mining Financing in Q2 - TheMinerMag

Feature

The Inside Story of Eric Trump’s American Bitcoin - WIRED

Charter Planes and Bidding Wars: How Bitcoin Miners Raced to Beat Trump’s Tariffs - WIRED

While non-mining companies often hold bitcoin as a long-term treasury asset, miners accumulate it through their core operations—and have stronger incentives to put it to use. The practice of deploying BTC reserves to generate returns or enhance liquidity began gaining traction during the 2020 halving cycle, particularly as institutional lending platforms became more accessible to miners.

By 2021, companies like Hut 8 had started allocating portions of their treasury to yield-generating strategies, including a 1,000 BTC loan to Genesis Capital that earned a 4% annual return. Hut 8 ultimately recalled those funds shortly before Genesis collapsed during the 2022 bear market. Several other counterparties—including BlockFi, Celsius, and Babel Finance—also collapsed amid broader market contagion.

Despite the risks, miners have continued to explore structured ways to deploy their BTC. MARA, one of the largest public bitcoin holders, held 49,951 BTC as of June 30, with approximately 15,550 BTC—or around 31%—actively allocated across lending agreements, asset management programs, and collateralized credit lines. Other major mining holders like CleanSpark have also established in-house treasury management functions to actively deploy their BTC reserves.

MARA’s latest quarterly filing offers fresh insights into how the company is managing its BTC treasury in the current cycle.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

Lending: 7,877 BTC

MARA began exploring bitcoin lending in 2024 through master securities loan agreements with multiple counterparties. These arrangements allow the company to loan out BTC in exchange for interest income, adding a yield component to its treasury strategy.

By the end of 2024, MARA had loaned out 7,377 BTC, as previously reported by TheMinerMag. In Q2 2025, the company expanded the program slightly, lending an additional 500 BTC. This brought the total under loan to 7,877 BTC as of June 30.

During the quarter, the lending program generated $6.8 million in interest income, bringing the year-to-date total to $13.1 million. Based on average BTC prices in Q1 and Q2, this equates to an annualized yield of approximately 3.5%.

Two Prime Account

To diversify its yield strategies, MARA partnered with asset manager Two Prime in Q2 to manage a portion of its BTC via a Separately Managed Account (SMA). The company transferred 500 BTC in mid-May to test the waters, followed by another 1,500 BTC in late June. As of June 30, a total of 2,004 BTC was under active management.

The initial tranche of 500 BTC generated 4 BTC over roughly 45 days—a return of 0.8%, or an annualized yield of 6.5%. This outpaces returns from lending, though it may also introduce higher active risk. The SMA prioritizes capital preservation and liquidity, with trades limited to bitcoin-denominated options, futures, swaps, and spot strategies.

Bitcoin-Backed Credit Lines

MARA is also leveraging its BTC as collateral to secure fiat liquidity through two credit lines:

Original Line of Credit: Established in October 2024 and amended in February 2025, this facility provides $200 million in credit backed by 4,499 BTC. It carries a 10.5% interest rate and begins maturing in 2026.

New Line of Credit: Opened in March 2025, this facility offers $150 million backed by 3,250 BTC at a lower 8.85% interest rate, maturing in March 2026.

At the time of transfer, the 7,749 BTC used as collateral was valued at over $554 million, providing substantial overcollateralization and financial headroom. As of June 30, 5,669 BTC remained locked as collateral, securing the $350 million outstanding across both facilities.

Both credit lines feature dynamic collateralization mechanisms. If BTC’s value fluctuates significantly, MARA must either top up or may reclaim collateral to maintain the required thresholds. These facilities offer flexible liquidity while preserving exposure to bitcoin’s long-term upside. Notably, similar structures were used in 2022 when Bitfarms was forced to liquidate its BTC holdings during a summer market crash.

Hardware and Infrastructure News

HIVE Surpasses 14 EH/s, Remains On Track to Reach 18 EH/s by End of Summer and 25 EH/s by U.S. Thanksgiving - Link

Auradine Shipped $73M Worth of Bitcoin Miners to MARA in H1 2025 - TheMinerMag

Corporate News

Bit Digital Seeks Shareholder Approval to Expand Share Capital for Ethereum Accumulation - TheMinerMag

Bitmain Plans First US Factory by Q3 in Trump Gambit - Bloomberg

Bitfarms Announces Second Principal Executive Office in NYC and Initiates Conversion to U.S. GAAP - Link

Financial News

Cryptofirm Bitzero secures $25m in funding to power mining operations - DataCenterDynamics

MARA Completes Upsized $950 Million Offering of 0.00% Convertible Senior Notes due 2032 - Link

Bitcoin Miner MARA Is Missing Out on AI Boom: Compass Point - Decrypt

Bitmain, the world’s largest Bitcoin mining rig manufacturer, is stepping up its U.S.-bound shipments of electronic parts as it adapts to shifting trade dynamics and weaker post‑halving demand.

Subscribe to TheMinerMag's APIs today and leverage monthly miner shipment records, plus a suite of proprietary metrics, to inform your most crucial business decisions. Click here to learn more!According to TheMinerMag’s monthly shipment records, Bitmain’s subsidiary in China began sending electronic components to its Delaware-based affiliate in June 2025—marking a notable change in logistics behavior. In total, the Chinese unit has shipped at least approximately 187,000 kilograms of electronic parts to the United States since June, a pattern not observed in earlier periods.

This move reflects Bitmain’s strategic shift toward localized assembly and manufacturing within the U.S., likely in anticipation of higher tariffs on Chinese-made products. The Trump administration has proposed escalating import duties on a wide range of Chinese goods, including electronics, which could significantly impact fully assembled mining hardware.

This isn’t Bitmain’s first reconfiguration of its U.S. logistics. As TheMinerMag previously reported, the company redirected over 50 EH/s worth of unsold Antminer S19XP machines from its Southeast Asian facilities to its Georgia subsidiary since 2023, likely for proprietary mining.

Those units, originally surplus from the bear market, appear to have been later repackaged under the balance sheet of Cango Inc., Bitmain’s newly established mining proxy on the NYSE.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

The pivot to shipping components rather than complete units suggests Bitmain is prioritizing domestic manufacturing to mitigate tariff exposure and retain flexibility in a volatile trade environment. Similarly, the U.S manufacuring partner of Bitmain’s major rival MicroBT has continued importing computer parts for assembling WhatsMiner machines since the beginning of the last bear market, according to TheMinerMag’s data.

Zooming out, Bitmain’s evolving shipping and manufacturing strategies point to broader challenges in the mining hardware sector. Demand for new machines has slowed after Q4, with hashprice and transaction fees stabilizing at low levels. At the same time, geopolitical tensions have made long-term supply chain planning increasingly complex for hardware makers caught between global demand and domestic policy shifts.

Regulation News

Trump Calls Coin Center Testimony the “Greatest Bitcoin Explanation of All Time” - TheMinerMag

Hardware and Infrastructure News

Canaan to Supply Cipher With Bitcoin Miners From US Facility Amid Tariff Concerns - TheMinerMag

Corporate News

Bit Digital acquires 19,683 ETH, growing treasury to over 120,000 ETH - The Block

Mawson CEO Fired for Cause Amid Accusations of Fraud and Misconduct - TheMinerMag

Antalpha Founder Takes Chair at Cango as Bitcoin Mining Pivot Concludes - TheMinerMag

Financial News

Bitcoin Mining Firm Stock Spikes After $500 Million Raise for Dogecoin Treasury - Decrypt

Bitfarms Launches Share Buyback Program as Riot Trims Stake Below 10% - TheMinerMag

MARA Plans $1 Billion Convertible Notes to Bolster Bitcoin Holdings, Repay Debt - TheMinerMag

While Bitcoin smashes through new highs above $120,000 and crypto and mining stocks whiplash on treasury announcements, one corner of the ecosystem refuses to join the mania: Bitcoin’s hashprice—and transaction fees—are behaving more like stablecoins than market-exposed assets.

Over the past week, the total crypto market cap hit a new record above $3.75 trillion. Ethereum and Solana have become unlikely favorites for corporate treasuries—particularly among Bitcoin mining companies. BitMine began accumulating ETH, and BIT Mining raised eyebrows with its pivot into SOL. Bit Digital, once a Bitcoin miner, is winding down its mining business entirely to go all-in on high-performance computing and Ethereum.

These altcoin treasury plays aim to replicate the success of Strategy’s Bitcoin playbook and echo the rollercoaster ride of Sharplink, which pivoted from an online performance marketing firm into an Ethereum treasury holder.

Now backed by Consensys, Sharplink (SBET) saw its stock soar from under $5 to nearly $80 in late May after announcing its ETH stockpile, only to crash below $10 in the following weeks, before rebounding to around $30.

Similarly, BitMine (BMNR)—a formerly obscure Bitcoin miner listed on the NYSE—saw its stock surge from $3 to $135 after unveiling its Ethereum treasury strategy earlier this month, before plunging back to $30.

And yet, the company’s website still declares: “At BitMine, Bitcoin isn’t a theory – it’s a cornerstone of our corporate strategy.” Ironically, BitMine made its first Bitcoin treasury purchase only in June, acquiring 100 BTC. A month later, it’s touting plans to become one of the largest Ethereum treasury holders, targeting $500 million in ETH.

For what it’s worth, these firms are at least enjoying wild volatility, and ETH is finally showing momentum, up 16% against BTC over the past week. Hashprice? It blinked—and went right back to sleep.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

After briefly spiking to a one-year high near $64/PH/s over the weekend, Bitcoin’s hashprice quickly settled back to around $60/PH/s following an 8% difficulty jump. Over the past year, hashprice has remained stuck in a narrow band around $50/PH/s. Over the past month, the hashprice went up by 9.8%, compared to all the double-digit gains shown above.

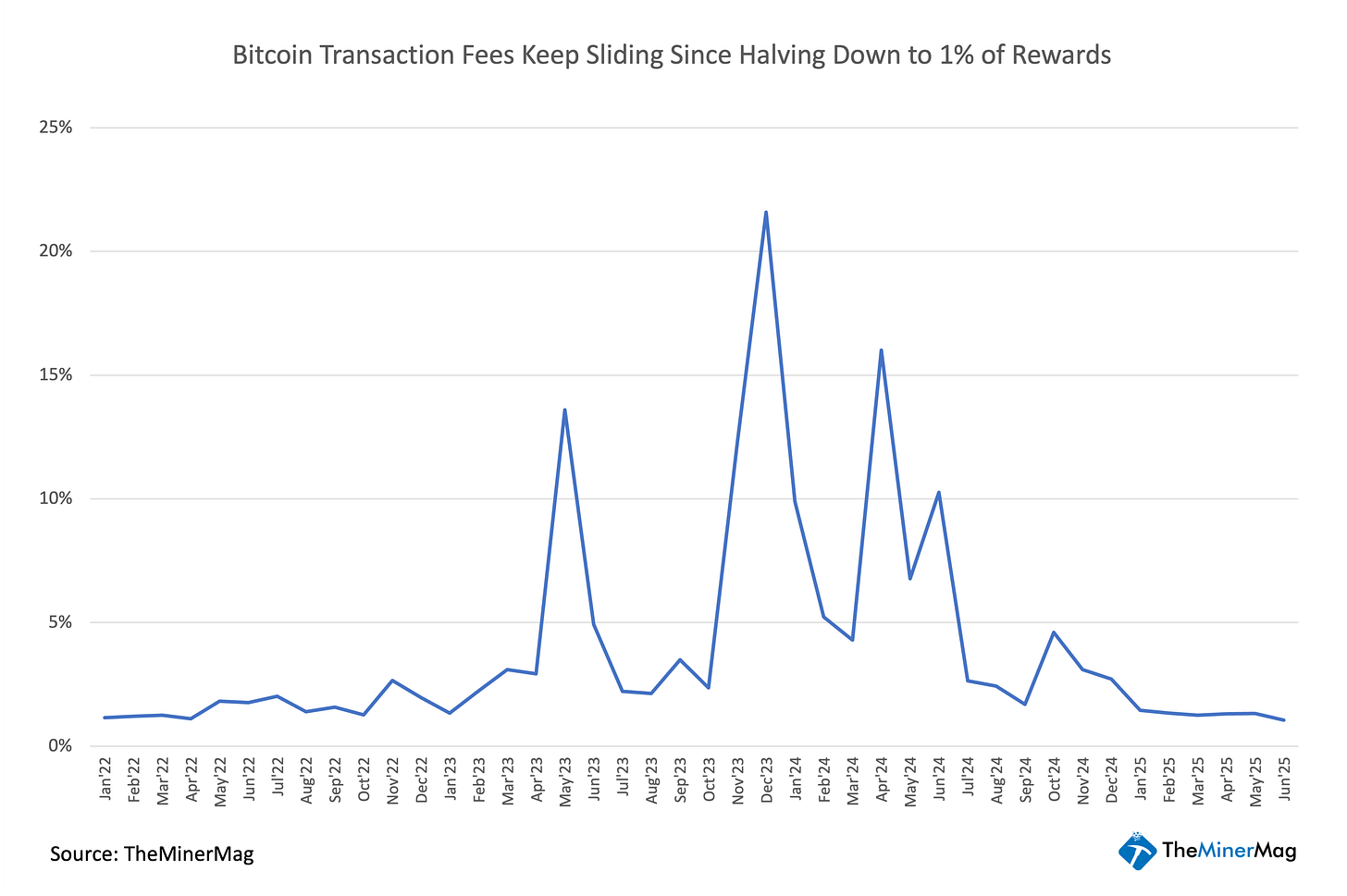

The same is true for transaction fees. With Bitcoin’s mempool unusually quiet, fees now contribute less than 1% of total block rewards. Inscriptions have dried up, and even regular congestion is absent. In a market where everything is mooning, blockspace demand is staying firmly on the ground.

Miners hoping to ride Bitcoin’s bull run may find themselves outpaced by the network itself. With the seven-day average hashrate crossing 940 EH/s again—just shy of an all-time high—another difficulty increase may arrive in about 9 days, threatening to erode any revenue gains from the rising BTC price.

Hardware and Infrastructure News

HIVE Exceeds 12 EH/s Milestone as Paraguay Expansion Progresses - Link

Corporate News

Former CFO of US Bitcoin Corp Joel Block Joins Cathedra Bitcoin as CEO - Link

MARA deepens Two Prime ties with $20 million equity stake, doubling down on bitcoin yield strategy - The Block

Peter Thiel-backed entities acquire 9.1% stake in Ethereum treasury firm BitMine Immersion - The Block

MARA Appoints Nir Rikovitch as Chief Product Officer - Link

Financial News

BIT Mining Shares Surge 160% in Premarket on Solana Treasury Plan - TheMinerMag

Bit Digital Eyes $67.3M Raise to Expand Ethereum Holdings in Continued Treasury Shift - TheMinerMag

Feature

Bitmain’s Trump Card - The Wire China (Behind paywall)

Big Changes Are Coming to the Texas Grid w/ Lee Bratcher - The Mining Pod

In previous market cycles, miner capitulation was a phenomenon reserved for the darkest days of the bear market—when margins were crushed and inefficient operators were forced offline. But this cycle is rewriting the script. Amid a robust bull market and bitcoin’s price hovering above $100,000, a different kind of capitulation is underway: one driven not by insolvency, but by strategic realignment.

The most telling example came recently from Core Scientific. Once the largest public bitcoin miner, Core has signed a definitive agreement to be acquired by CoreWeave, the Wall Street-favored AI infrastructure player that began life as an Ethereum miner. With a realized hashrate of 12 EH/s, Core Scientific’s mining fleet is still formidable. But signs point to an eventual divestiture of its bitcoin mining business altogether, as CoreWeave eyes Core’s data center footprint to scale high-performance computing (HPC) workloads. This also raises questions about the fate of Core’s 15 EH/s preorder with Jack Dorsey’s Block.

Meanwhile, Bit Digital announced it would wind down its bitcoin mining segment due to the limitation imposed by its asset-light mining model and pivot entirely to an Ethereum-based treasury strategy. The company previously sold BTC for ETH in June 2024 and doubled down by raising $172 million in June 2025 to expand its ETH holdings. With BTC-to-ETH exchange rates now less than half of what they were during its first swap, the company’s move is both bold and revealing: a conscious retreat from the mining business amid what it sees as structurally challenged economics.

This moment signals a deeper shift in how investors view the mining sector.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

From Leveraged Bitcoin Proxies to AI Infrastructure Plays

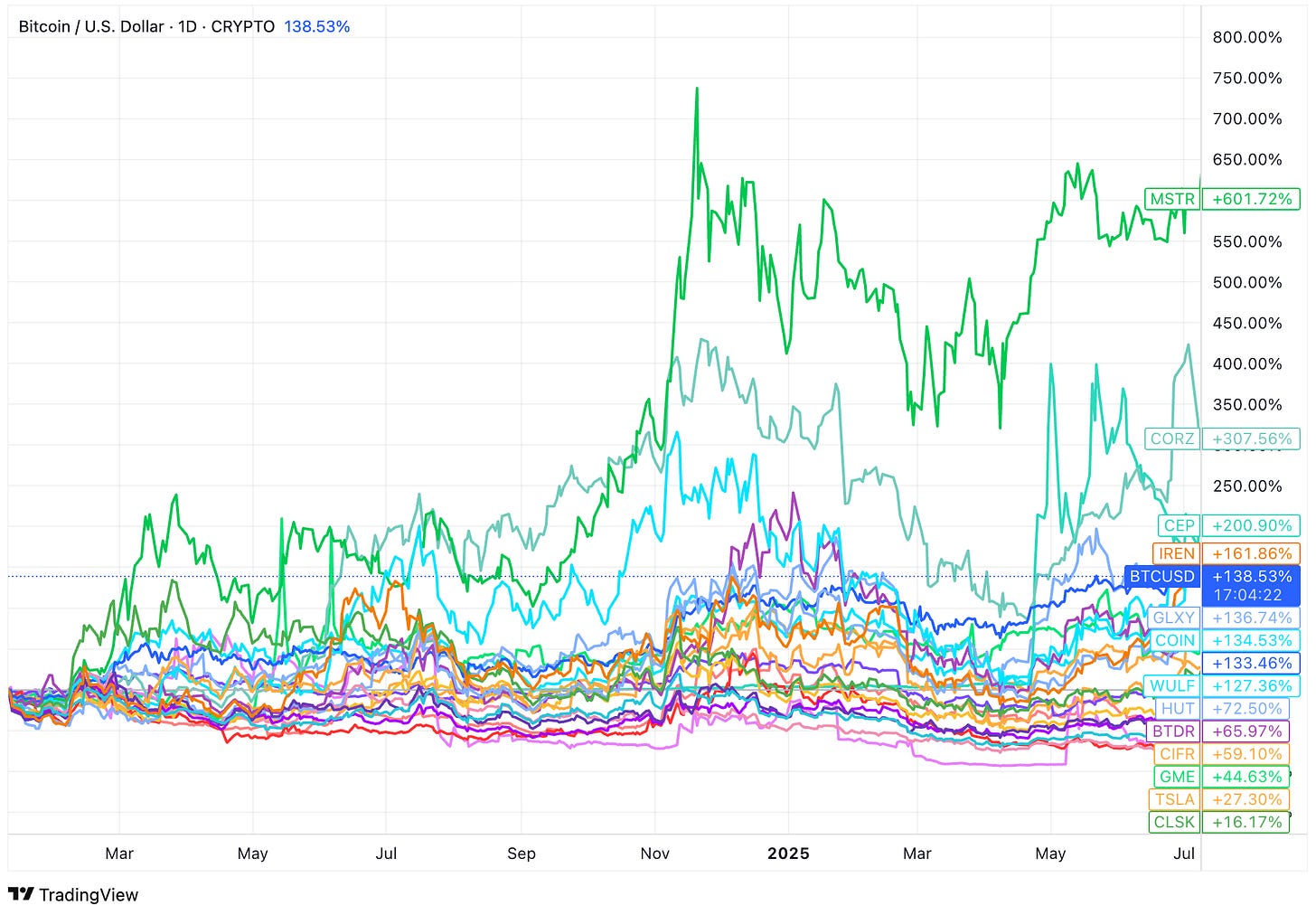

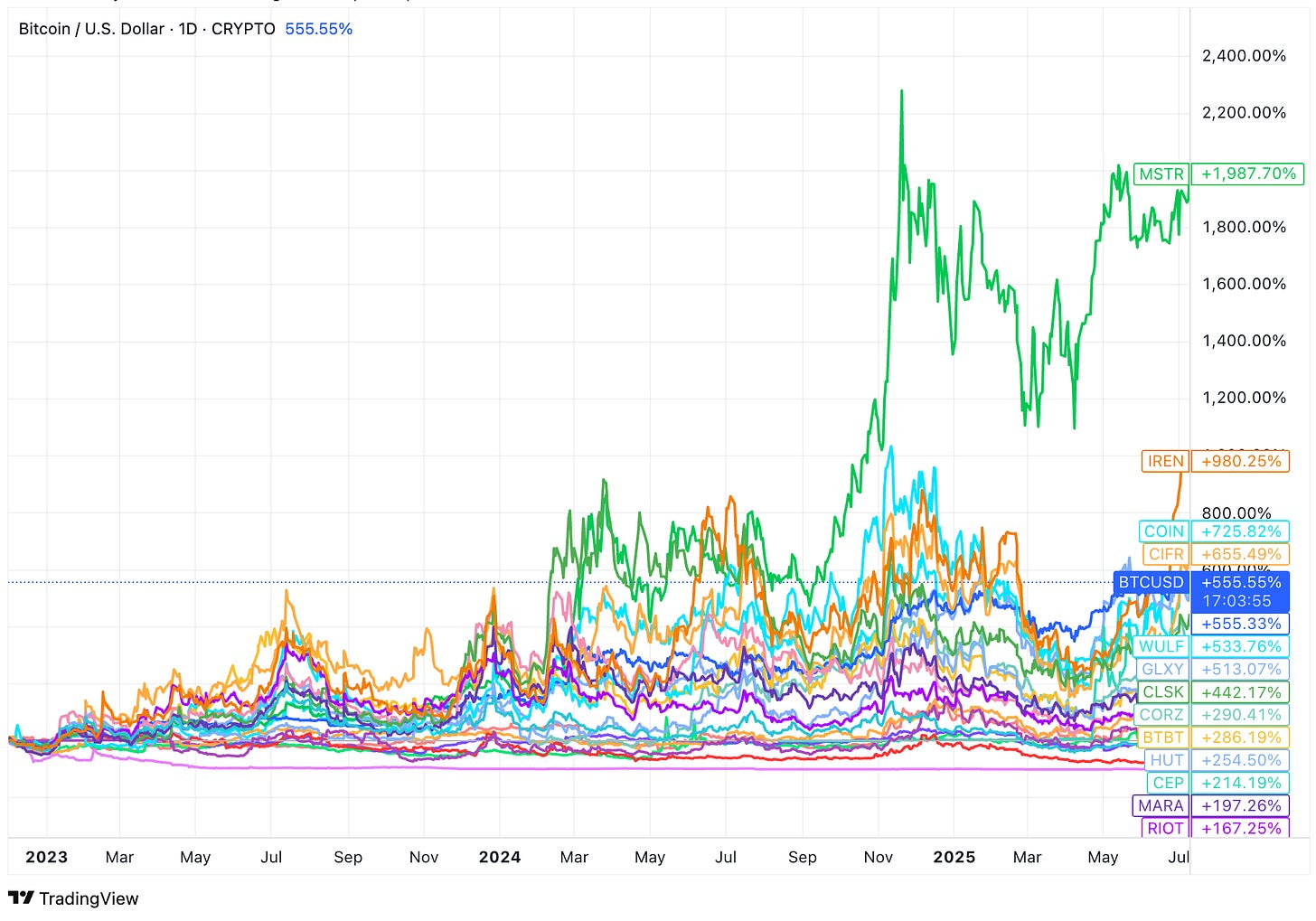

Bitcoin mining stocks once acted as high-beta exposure to BTC—amplifying its moves both up and down. But the arrival of spot bitcoin ETFs in January 2024 has flattened that leverage trade. Investors who once chased mining stocks for turbocharged gains can now access BTC exposure directly with institutional ease.

Since the ETFs’ launch, only two mining-adjacent stocks have outperformed bitcoin itself: Core Scientific (CORZ) and Iris Energy (IREN). Notably, these are not traditional bitcoin treasury vehicles. IREN sells all its mined BTC daily, and CORZ only began holding a small amount recently—under 1,000 BTC. Their outperformance stems not from BTC exposure, but from strategic pivots to AI and HPC, aligning with a broader investor appetite for compute infrastructure over commodity-style mining.

By contrast, most miners with large BTC treasuries have underperformed bitcoin post-ETF. The only consistent exception has been MicroStrategy (MSTR), whose aggressive laser focus on BTC accumulation continues to pay off. The divergence raises a compelling question: Can other mining firms – and also many other bitcoin treasury stocks – replicate MicroStrategy’s success by turning into bitcoin-holding entities? So far, the answer appears mixed—many are seeing short-term wins but still trail BTC over a longer horizon.

Even since the bottom of the last bear market in late 2022, only a handful of public miners—IREN, Cipher Mining (CIFR), and Terawulf (WULF)—have managed to outperform or match the performance of BTC. All others, despite having varied treasury or operational strategies, have lagged. The story they tell is not one of uniform failure, but of a rapidly changing competitive landscape where diversification and adaptability seem to matter more than raw exposure to bitcoin.

As hashprice pressures mount and AI infrastructure demand accelerates, the sector could be entering a new phase. Capitulation no longer means bankruptcy—it could mean reallocation. For public mining companies, the fork in the road is becoming clearer than ever: double down on bitcoin treasury or pivot to broader compute infrastructure (or both?) and try to outrun the cycle altogether. This isn’t just a new chapter in the bitcoin mining story. It might be a whole new genre.

Hardware and Infrastructure News

Bitcoin Mining Difficulty Poised to Rebound as Hashrate Recovers to 900 EH/s - TheMinerMag

BitFuFu Hits 36.2 EH/s Hashrate, 728 MW Capacity in June - CoinDesk

CleanSpark Hits 16.15 J/TH in Efficiency as It Reaches 50 EH/s Milestone - CoinDesk

Corporate News

Tether plans further Bitcoin mining expansion in South America with Adecoagro tie up - The Block

Esports Giant Ninjas in Pyjamas Buys Bitcoin Miners, Expects Monthly Production of $6.5M in BTC - Decrypt

CoreWeave to Acquire Core Scientific in All-Stock Deal to Expand AI Infrastructure - TheMinerMag

CoreWeave’s All-Stock Bid for Core Scientific Likely to Draw Shareholder Scrutiny: KBW - CoinDesk

Bit Digital Goes All-In on Ethereum, Converts Bitcoin and Equity Proceeds into ETH Holdings - TheMinerMag

Financial News

CORZ, HUT, IREN Among BTC Miners Shedding Recent Gains After CRWV Deal - CoinDesk

BIT Mining Shares Surge 150% in Premarket on Solana Treasury Plan - TheMinerMag

After months of slow growth and subdued activity, the U.S. public Bitcoin mining sector appears to be roaring back to life—and not quietly. In just over a week, three of the industry’s largest players—CleanSpark, Cango, and IREN—each announced they have surpassed 50 EH/s of installed hashrate. Not far behind, MARA, currently the largest mining operation, declared an ambitious new target to hit 75 EH/s by the end of this year, supported by machine orders already in place.

Taken together, the four firms now control over 200 EH/s, equivalent to more than 20% of the current Bitcoin network, and matching the network’s entire hashrate at the peak of the last bull cycle in late 2021. It’s a striking signal that the arms race is not only back on—it may never have really stopped.

Each of the miners arrived at this threshold through a distinct route. CleanSpark crossed the 50 EH/s line by staying the course on its infrastructure expansion strategy. And so is IREN, which reached the milestone organically by the development of its Childress site in Texas, where 650 megawatts are now energized. However, IREN likely won’t join any further arms race as it previously noted that it would halt hashrate expansion to focus on AI infrastructure once it hits the 50 EH/s mark.

Cango, on the other hand, took a more unconventional route. The company, which pivoted from its legacy auto-financing business, has rapidly built its mining footprint by acquiring energized hashrate from Bitmain-affiliated entities. Its most recent deal added 18 EH/s of on-rack capacity to its previous 32 EH/s, pushing it above the 50 EH/s mark by ceding its ownership to Bitmain’s Antalpha. Effectively, Bitmain has taken its 50 EH/s mining assets public by using Cango as a shell.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

MARA, already the largest public miner by nameplate capacity, didn’t announce a new milestone—but instead set the bar even higher. In its June update, the company said it aims to hit 75 EH/s by year’s end, supported by a pipeline of over 3 gigawatts of infrastructure and machine orders already placed. MARA has largely held its capacity steady near 55 EH/s for the first half of the year, but its latest comments suggest that a fresh ramp-up is imminent, involving new deliveries from partners like Auradine, in which MARA holds an equity stake.

While these four dominate the current leaderboard, a number of smaller public miners are also scaling aggressively. Cipher Mining is on track to exceed 23 EH/s this year following expansions at its Black Pearl site in Texas. HIVE Digital projects it will reach 25 EH/s through ongoing buildouts in Paraguay by the U.S. Thanksgiving. And American Bitcoin—a proprietary mining unit of Hut 8 backed by the sons of U.S. President Trump—has already raised $220 million in private equity to pursue its goal of 25 EH/s, though it has yet to disclose a timeline.

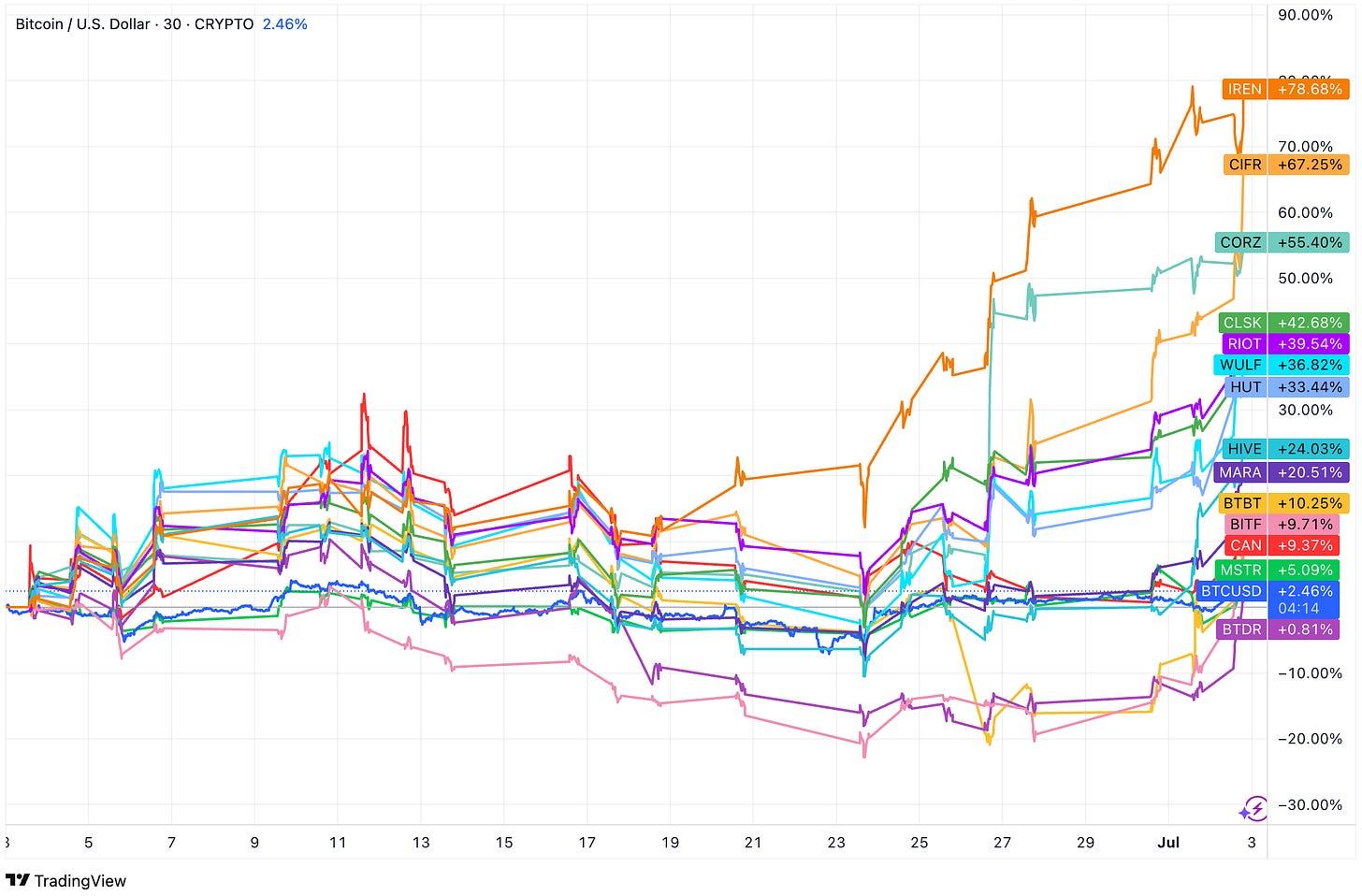

Alongside this hashrate escalation, another race is unfolding—this one on Wall Street. Over the past month, Bitcoin mining stocks have rallied sharply, significantly outperforming BTC itself, as shown in the chart below.

Miners are not just scaling hashrate; they’re also vying to become the top-performing equity in the sector. IREN has led the charge with a +78% gain in June, followed closely by Cipher (+67%) and Core Scientific (+55%). CleanSpark, Riot, and Hut 8 also posted gains between 30%–45%, with Marathon up just over 20%. Bitcoin, by comparison, has moved up just 2.5% during the same period.

This wave of growth underscores an increasingly consolidated and capital-intensive Bitcoin mining landscape. With hashprice still under pressure and transaction fees remaining low, smaller or less efficient miners may struggle to keep pace. While the recent sharp drop in difficulty offered a brief reprieve, the network’s average hashrate has since rebounded and pushed average block production to around 9.4 minutes. If this upward trend continues, mining difficulty could return to its all-time high in the next 10 days.

Regulation News

‘Kill shot’: GOP megabill targets solar, wind projects with new tax - Politico

Hardware and Infrastructure News

Cango Finalizes 18 EH/s Mining Acquisition, Surpasses 50 EH/s as Antalpha Ties Deepen - TheMinerMag

Bitcoin Hashprice Nears 5-Month High After Record Difficulty Drop since China Ban - TheMinerMag

IREN Joins Bitcoin Mining Peers in Surpassing 50 EH/s Milestone - TheMinerMag

Compass Mining Energizes New 4.5 MW Site in Iowa in Partnership with DIGTB - Link

Summer Curtailments Slash Bitcoin Production for US Miners Amid Grid Pressures - TheMinerMag

Corporate News

CoreWeave in Talks to Buy Core Scientific: The Wall Street Jounral

CleanSpark Hires Planning Commissioner Amid Outcry Over Proposed Bitcoin Mine in Tennessee - TheMinerMag

Argo Stock Crashes Over 60% Amid Bitcoin Mining Restructuring to Avert Insolvency - TheMinerMag

Oil spill at Bitcoin mining facility sparks water safety concerns near Seneca Lake - WHAM

MARA Targets 75 EH/s by Year-End with Bitcoin Miner Orders in Place - TheMinerMag

Riot Liquidates Another 6.4M Bitfarms Shares to Reduce Stake to 12.3% - Link

Hut 8 signs five-year capacity contracts with Ontario grid operator for gas-fired power plants - The Block

Trump Sons-Backed American Bitcoin Raises $220M to Fuel Hashrate Expansion - TheMinerMag

Feature

A Remote Himalayan Kingdom Bet Big on Bitcoin Mining. So Far, It Has Paid Off - The Wall Street Journal

After reaching an all-time high of nearly 950 EH/s earlier this month, bitcoin’s seven-day moving average hashrate has slipped to around 810 EH/s—a notable 15% pullback. The decline has sparked widespread speculation online, with some attributing the drop to geopolitical tensions following the U.S. strike on Iranian nuclear facilities.

Posts circulating on X claim that the attack coincided with the hashrate dip and suggest it may have taken Iranian miners offline, removing “secret hashrate” from the network. Others are reviving perennial fears of a “hashrate crash,” pointing to the one-day average hashrate briefly dipping to 600 EH/s.

Many of these interpretations misunderstand how Bitcoin’s hashrate is actually estimated—an error that recurs as reliably as the network’s halving cycle.

Bitcoin’s hashrate is derived from mining difficulty and block production intervals, which means short-term figures can swing wildly due to randomness. The one-day hashrate metric is particularly volatile and often reflects statistical noise—essentially, how “lucky” miners get—rather than any fundamental shift in network capacity. By the same logic, it would be misleading to claim that Bitcoin’s hashrate has surpassed 1 zettahash based solely on a one-day spike.

For those interested in the technical details:

Hashrate (hashes per second) = Difficulty × 2³² / Average block interval (in seconds)

In this equation, the numerator remains constant throughout a given difficulty epoch, so fluctuations in estimated hashrate are entirely driven by variations in block production time.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

Each market cycle brings a wave of newcomers who misread these fluctuations. The “hashrate crash” narrative resurfaces whenever metrics decline sharply, despite the probabilistic nature of block production in Bitcoin mining.

A more grounded explanation points to seasonal curtailment in North America as the likely cause. Pool-level data (see snapshot below) shows that the steepest drop came from Foundry USA Pool, which intermittently went offline before rebounding. This pattern is consistent with summer grid management in the U.S., where miners curtail operations during peak electricity demand to help stabilize the grid.

Even if some Iranian capacity was disrupted, the impact appears marginal compared to the widespread curtailments affecting major U.S.-based pools. It’s also unlikely that significant Iranian hashrate would be routed through Foundry USA, a U.S.-based pool subject to sanctions compliance.

Looking ahead, bitcoin’s next difficulty adjustment is expected around June 29 and could mark the steepest downward retarget since the aftermath of China’s 2021 mining ban—potentially steeper than the -7.32% drop seen during the 2022 bear market’s miner capitulation.

That said, the network hashrate appears to be recovering. The projected difficulty adjustment, which was estimated at nearly -10% a few days ago, is now expected to be slightly under -8%.

Regardless of the final figure, the anticipated difficulty drop should offer some temporary relief—especially for miners operating at the margin amid post-halving economics and summer curtailments.

Regulation News

Norway plans temporary ban on power-intensive cryptocurrency mining - Reuters

Hardware and Infrastructure News

HIVE Surpasses 11 EH/s on Track to Reach 25 EH/s by U.S Thanksgiving - Link

MARA Taps Auradine for Half of 2025 Bitcoin Mining Rig Orders - TheMinerMag

HIVE Acquires 7.2MW Toronto Data Center to Expand AI Infrastructure - TheMinerMag

Cipher Mining Begins Bitcoin Production at 300 MW Black Pearl Data Center - CoinDesk

Genesis Buys US-Made Auradine Bitcoin Miners Amid Tariff Concerns - TheMinerMag

Compass Expands Bitcoin Mining Hosting with Soluna to 13 MW - TheMinerMag

CleanSpark Becomes Second Bitcoin Miner to Report Reaching 50 EH/s Mark - TheMinerMag

Corporate News

Riot Unloads Another 6.5M Bitfarms Shares, Cutting Stake to 13.4% - TheMinerMag

Canaan discontinues AI chip business, which generated less than $1 million of revenue in 2024 - Link

Bit Digital Raises $150M to Buy ETH, Quits Bitcoin Mining - TheMinerMag

Financial News

Bit Digital Secures $44M Credit Facility from RBC for AI Data Center Expansion - TheMinerMag

Hut 8 Doubles Bitcoin-Backed Credit Line with Coinbase to $130M - TheMinerMag

Feature

What Tariffs Will — and Won’t — Change for U.S. Bitcoin Miners - Coindesk

Mining Bitcoin is about to get a whole lot easier — here’s what’s driving it - DL News

After a volatile post-halving stretch, Bitcoin mining is entering a quieter phase — and not just on-chain. Transaction fees, which briefly spiked during the Runes-driven activity in April 2024, have now dropped to their lowest share of miner revenue since the last bear market bottom.

So far in June, Bitcoin transaction fees have accounted for just 1.05% of total block rewards, according to TheMinerMag’s data — a decline from the 1.3% figure in May and a steep fall from the 10.25% seen in June 2024. The drop tracks with a slowdown in on-chain usage: the seven-day average for Bitcoin transactions has sunk to its lowest point since October 2023.

This decline undermines the post-halving narrative that transaction fees would naturally take up a larger share of miner rewards as block subsidies fall. Instead, fee-based revenues have collapsed just as operational costs remain high, squeezing margins and making even modest mining operations harder to sustain.

The effects are beginning to show not only in financial statements but in corporate communication practices. Several public miners have quietly stopped issuing monthly production updates, once a staple of investor transparency.

Argo Blockchain, Bit Digital, Terawulf, Hut 8, and Bitfarms stopped providing production figures one by one over the past few months. Core Scientific has also stopped publishing its Bitcoin hodl and hashrate updates, though it continues to publish daily and monthly BTC mined via X.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

While the silence is not uniform, it is widespread enough to suggest more than just oversight.

Internal challenges may also be a factor. According to TheMinerMag’s latest research, Terawulf experienced a sharp energy cost spike in Q1 2025, which may explain its retreat from monthly updates, particularly since the company previously reported detailed power pricing in its monthly disclosures.

Bit Digital and Argo, meanwhile, saw hosting disruptions after their contracts were terminated by Coinmint and Galaxy, respectively. And Hut 8’s withdrawal from production updates coincides with the spinout of its proprietary mining business into the newly formed American Bitcoin Corp.

For some, in a high-cost, low-fee environment, transparency may now be seen more as a liability than a virtue.

Hardware and Infrastructure News

Dominant Chinese makers of bitcoin mining machines set up US production to beat tariffs - Reuters

Bitcoin Miners Face More Trouble as Transaction Fee Share Hits 3-Year Low - Decrypt

Corporate News

Bitcoin Miner Price Targets Raised to Reflect Improved Mining Economics: JPMorgan - CoinDesk

Financial News

IREN closes upsized $550 million convertible notes offering - Link

Bitdeer Cuts 8.5% Bitcoin Mining Debt with Shares at 60% Discount in $330M Raise - TheMinerMag

Feature

Bitcoin Mining Update: May/June 2025 - TheMinerMag

Amazon joins the big nuclear party, buying 1.92 GW for AWS - TechCrunch

The Trumps Promote a New Crypto Venture: Bitcoin Mining - NYT

American Bitcoin Corp (ABTC), the new proprietary Bitcoin mining carve-out from Hut 8, backed by Eric Trump and Donald Trump Jr., is taking shape as it prepares to go public.

The company recently filed an S-4 registration statement as part of its merger with Gryphon Digital, offering fresh insight into its financials, mining strategy, and reliance on Chinese-manufactured hardware as it aims to scale to 25 EH/s.

ABTC, officially launched on April 1, 2025, is the vehicle through which Hut 8 is spinning off its self-mining business, allowing the parent company to focus on power and data center infrastructure. The filing helps explain why Hut 8 has stopped publishing monthly Bitcoin production updates since April.

In Q1 2025, ABTC mined 135 BTC, consistent with what Hut 8 had produced from its proprietary operations (excluding its share of joint ventures) prior to the spin-off. As of May 31, ABTC held about 215 BTC in reserves.

ABTC currently owns 10.17 EH/s of hashrate capacity hosted at Hut 8’s facilities, powered by a mix of Bitmain’s S21 series and MicroBT’s M5X and M6X series miners. But its most ambitious growth lever comes from a 15 EH/s hosting deal that Hut 8 originally signed with Bitmain last year. Under the agreement, Hut 8 committed to building out hosting infrastructure tailored for Bitmain’s new U3S21EXPH systems—machines that deliver 860 PH/s each. Once the buildout is complete, Hut 8 holds an option to purchase the entire hardware set.

Hut 8 had previously withheld pricing details on the deal when it was announced in September. The S-4 filing now discloses that the maximum purchase price for the 17,280 U3S21EXPH units is approximately $320 million, implying a cost of about $21/TH/s before tariffs and duties. Hut 8 retains the right to cause ABTC to acquire the full batch of machines to drive future growth.

If fully executed, this purchase path would put ABTC on track to exceed 25 EH/s in capacity—placing it among the top publicly traded Bitcoin miners globally.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

Another noteworthy disclosure in the filing is ABTC’s direct production cost for the 135 BTC mined in Q1, which totaled $11.65 million (excluding depreciation and amortization), or $86,303 per BTC. This figure either reflects Hut 8’s higher-than-peer-average power and maintenance cost or is intended to bolster Hut 8’s recurring hosting revenue from ABTC as Hut 8 pivots away from proprietary mining.

However, ABTC’s growth plans may face geopolitical headwinds. The S-4 filing notes the company’s dependence on imported Bitcoin mining equipment and flags the risk of higher U.S. tariffs on mining hardware made by Chinese companies.

“While the final scope and application of recently announced changes in U.S. trade policy remains uncertain at this time, higher tariffs on imports and subsequent retaliatory tariffs could adversely impact ABTC’s ability to import equipment at levels that are cost effective,” the filing states.

It remains to be seen how a company with American in its name will adapt to such shifting geopolitical dynamics, as its whole fleet, at least for now, relies on Chinese suppliers.

Hardware and Infrastructure News

Bitcoin network transaction activity reaches lowest level since Oct. 2023 - The Block

HIVE Lifts Realized Bitcoin Hashrate by 32% in May Amid Paraguay Expansion - TheMinerMag

Corporate News

Trump-backed American Bitcoin mining firm acquires first $23 million worth of BTC - The Block

Canaan Boosts Bitcoin Production 25% on Hashrate Ramp-up - TheMinerMag

Financial News

Bitcoin Miner Riot Trims 8.85 Million Bitfarms Shares at Loss - TheMinerMag

IREN Prices $500M Convertible Bonds as Bitcoin Miner Ramps Up Debt Financing - TheMinerMag

BitFuFu Plans $150M ATM Amid Bitcoin Miner Funding Slowdown - TheMinerMag

Bitdeer Raises $50M From Tether as Bitcoin Production Jumps 18% - TheMinerMag

In 2017, the corporate crypto buzzwords were ICOs and blockchain. Earnings calls and conference panels were filled with talk of distributed ledgers and tokenized business models. Fast forward two halving cycles, and the conversation has radically shifted.

Today, no one’s asking about a “blockchain strategy”—they’re asking how much Bitcoin you hold. From Wall Street institutions to renewable energy firms to meme-stock veterans, public companies are increasingly turning to Bitcoin—not as a tech curiosity, but as a treasury asset in a world of debt, dilution, and monetary uncertainty.

Bitcoin miners are natural believers in the treasury use case (though some aren’t holding at all). According to data tracked by TheMinerMag, more than a dozen publicly traded mining firms collectively hold nearly 100,000 BTC on their balance sheets. But since the 2024 halving, the Bitcoin treasury trend—and the stock performance of companies embracing it—has extended well beyond the mining sector.

As of June 2025, the adoption of Bitcoin as a corporate treasury asset continues to gain momentum. Standard Chartered recently reported that at least 61 public companies collectively hold approximately 673,897 BTC—around 3.2% of the total supply.

Yet that figure may significantly understate the real picture.

Bitcointreasuries.net, a tracking site curated by Coinkite, lists 124 public companies globally with combined holdings of 816,958 BTC. Including private firms and sovereign entities, total holdings are estimated to exceed 3.3 million BTC.

Below are some of the newest entrants in the Bitcoin treasury movement.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

🔑 Newest Additions to the Bitcoin Treasury Movement

🟪 GameStop Corp.

GameStop revealed it had purchased 4,710 BTC in late May—its first formal Bitcoin acquisition. Though the stock fell 10.9% on announcement day, that followed a sharp multi-day rally as rumors swirled.

🟥 Trump Media & Technology Group

The company raised $2.3 billion via share and convertible debt issuance to build a Bitcoin reserve. Its stock gained 2.1% following the news, bucking a broader market dip.

🟦 Twenty One Capital

Twenty One Capital has quickly emerged as a major player, accumulating over 42,000 BTC and raising $685 million. It’s going public via SPAC merger with Cantor Equity Partners, and Cantor’s stock soared over 460% following the announcement.

🟧 Strive Asset Management

Strive is merging with Colombier Acquisition Corp. to go public while adopting a Bitcoin-first treasury strategy. The firm, co-founded by Senate candidate Vivek Ramaswamy, brands itself as a pro-Bitcoin alternative to traditional ESG-driven asset managers.

🟩 K Wave Media (KWM)

Korean firm KWM is building what it calls the “Metaplanet of Korea,” initiating a $500 million capital facility to support Bitcoin accumulation and treasury integration.

🇨🇦 SolarBank Corp.

The Canadian clean energy developer announced it would adopt Bitcoin as a strategic reserve asset, tying its pro-renewable mission to the long-term potential of decentralized money.

🇳🇴 HarmonyChain

Norway-based HarmonyChain joined the wave in late May, becoming one of the first Nordic-listed companies to adopt a formal Bitcoin treasury strategy. The firm disclosed its first Bitcoin purchases and said it plans to make BTC a long-term reserve asset, citing inflation concerns and global monetary instability (source).

Regulation News

Pakistan’s bold Bitcoin move draws IMF scrutiny - SAMAA

Atlanta expands restrictions on where data centers can be built - The Atlanta Journal-Constitution

Final Johnson City crypto mine zoning vote Thursday, miner 'continues to' look at site - WCYB

Hardware and Infrastructure News

Bitcoin’s Mining Difficulty Hits Record High, Erasing Recent Hashprice Gains - TheMinerMag

Applied Digital Shares Surge 40% on 250 MW AI Lease with CoreWeave - TheMinerMag

Corporate News

Cango Founders Cede Control to Antalpha in Bitcoin Mining Shift - TheMinerMag

Riot Hires Data Center Chief as Bitcoin Miner Ramps Up HPC and AI Hosting Plans - TheMinerMag

MARA, CleanSpark, Riot Drive Record Bitcoin Hashrate Surge in May - TheMinerMag

Mountain City Approves Trip to Tour CleanSpark Bitcoin Mine Amid Local Opposition - TheMinerMag

Feature

AI could consume more power than Bitcoin by the end of 2025 - The Verge

Bitmain has announced the rollout of its latest Bitcoin mining machine, the Antminer S23 Hydro, at its flagship WDMS 2025 event this week. The new hardware boasts an efficiency of 9.7 J/TH and is scheduled to begin shipping in Q1 2026. This development marks a significant leap in mining technology, pushing the industry into a sub-10 J/TH efficiency era – a stark contrast to the 1,200 J/TH efficiency of the first-ever Bitcoin ASIC miner launched in 2013.

While such technological advancements might suggest a familiar hashrate growth narrative, the current market conditions paint a more complex picture. Traditionally, Bitmain and other hardware makers have launched next-generation mining rigs with major efficiency gains during bear markets, as miners prepare for the next halving cycle. However, the introduction of the S23 series coincides with Bitcoin’s rally beyond $100,000 – a scenario not seen before. More tellingly, Bitmain is offering flexible payment terms during the event, including accepting Bitcoin as collateral from buyers, signaling the shifting dynamics in the mining hardware market, as detailed in a previous issue.

The prevailing challenge stems from the disconnect between Bitcoin’s soaring price and the lagging hashprice – the amount miners earn per unit of computational power. According to TheMinerMag, Bitcoin’s hashprice dipped below $40/PH/s in April, while the median fleet hashcost for major public mining firms during the first quarter hovered around $35/PH/s. This squeeze on profitability has prompted several large mining firms to pause or scale back their hashrate expansion plans.

The implications of this shift are profound. Historically, new hardware cycles have driven network growth and hashrate expansion. Today, however, much of the demand for the latest mining technology, including sub-10 J/TH equipment like the S23 Hydro, may come from miners upgrading existing fleets rather than pursuing aggressive expansion. This change is driven by a compressed hashprice and concerns about future profitability.

As TheMinerMag projected in a previous research, the rate of hashrate increase may gradually plateau after the current halving epoch. The widespread adoption of highly efficient mining equipment could not only stabilize but potentially reduce the network’s overall power consumption – a trend not seen in previous cycles.

Looking ahead, the combination of an evolving hardware landscape, muted hashrate growth, and the uncertain trajectory of hashprice raises critical questions for the industry. If Bitcoin’s hashprice struggles to recover to pre-2024 halving levels (about $100/PH/s) during a bull market, miners may face heightened pressures during future downturns.

The rollout of the Antminer S23 Hydro is thus not just a technological milestone but also a reflection of the industry’s shifting realities, where efficiency gains are no longer solely a catalyst for growth but a necessity for survival.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

Regulation News

Pakistan Allocates 2GW Power Capacity to Boost Bitcoin Mining - TheMinerMag

Hardware and Infrastructure News

HIVE Surpasses 10 EH/s of Bitcoin Hashrate as Expansion in Paraguay Accelerates - Link

Bitmain Unveils S23 Bitcoin Miner Touting 9.5 J/TH Efficiency - TheMinerMag

Russia Could Relocate Bitcoin Miners To Northern Regions: Report - Decrypt

Green Flare Plans 53 MW of Flare Gas Bitcoin Mine in Nigeria - TheMinerMag

Corporate News

MARA Closing in on Record Realized Bitcoin Hashrate Above 50 EH/s - TheMinerMag

Compass Mining Partners with Synota's "Impact Mining" Initiative to Transform Bitcoin Hashrate into Community Impact - Link

IREN co-founder and co-CEO Dan Roberts smashes Central Coast record with AU$ 15.5 million beachfront pad - AFR

Ionic Digital Issues Statement Following Delaware Chancery Court Ruling - Link

TeraWulf Acquires Beowulf Electricity & Data, Streamlining Corporate Structure - Link

Feature

Kentucky’s Bitcoin Boom Has Gone Bust - WIRED

The Bitcoin hum that is unsettling Trump's MAGA heartlands - BBC

After a steep sell-off that lasted much of Q1, Bitcoin mining stocks are showing new signs of life—bouncing back as Bitcoin approaches fresh all-time highs above $100,000. But this isn’t a rising-tide-lifts-all-boats story. The sharpest rebound has been concentrated among miners with active high-performance computing (HPC) or AI hosting initiatives, as investors begin to differentiate based on growth potential beyond Bitcoin.

The turnaround follows Bitcoin’s recovery from a low of $75,000 in early April, triggered by geopolitical tensions and broader market volatility. During the decline, most publicly listed miners underperformed BTC significantly. Bitdeer (BTDR), Cipher (CIFR), Core Scientific (CORZ), and Terawulf (WULF) all shed more than 50% of their value between January and early April.

But since Bitcoin bottomed on April 7, the rebound has been swift and selective. Bitdeer, previously the most heavily sold stock among miners, has rallied nearly 80%. Core Scientific, Terawulf, Cipher, and Iris Energy (IREN) have each posted gains over 50%, outpacing Bitcoin’s own recovery. Notably, these are the companies that have either launched or committed to scaling their data center footprint to support AI or HPC workloads.

In contrast, miners with pure-play Bitcoin exposure and no diversification strategy have seen a slower recovery. While most names have bounced from the April lows, those lacking a compelling growth narrative—especially around AI or hosting—have posted relatively slower recovery over the past month. With that being said, CleanSpark is the only mining stock that maintains a YTD gain thanks to consistent operational execution and select expansion moves, but it too is treading carefully.

The message seems clear: while the market is rewarding Bitcoin mining stocks again, it is doing so selectively, favoring those with a forward-looking strategy and diversified infrastructure growth. In this new phase of the cycle, investors appear increasingly attuned to which miners are building for the next decade, not just the next halving.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

Hardware and Infrastructure News

Cango Set to Add 18 EH/s Bitcoin Hashrate by July, Approves $352M Sale - TheMinerMag

Auradine Expands Bitcoin Mining Solutions with ASIC chips, Range of Advanced Cooling Systems and Modular Megawatt Containers - Link

Crusoe Enters Second Phase of Building an OpenAI Texas Data Center - Bloomberg

HIVE Crosses Record 9.5 EH/s Milestone - Link

Soluna to Launch First Solar-Powered Data Center With 75 MW Project - Link

Corporate News

Core Scientific Appoints Elizabeth Crain to Board of Directors - Link

MARA to allocate 500 BTC to Two Prime in expanded yield strategy - The Block

Financial News

Riot Doubles Bitcoin-Backed Credit Facility with Coinbase to $200 Million - TheMinerMag

Cipher Mining Raises $150M to Accelerate Bitcoin Miner Shipments - TheMinerMag

Sangha Raises $14M for Texas Solar Bitcoin Mining Project - TheMinerMag

Low Hashprice Forces Bitcoin Miners to Sell Record BTC Ahead of $109k ATH - CoinDesk

If you were around during previous bull markets, you likely remember the steep price premiums on mining equipment during bitcoin’s gold rush. Back in 2017, for example, Bitmain sold millions of Antminer S9 units, generating $2.5 billion in revenue that year and another $2.7 billion in just the first half of 2018. At the time, a single S9 could fetch hundreds of dollars per terahash per second.

This cycle, however, tells a different story.

In a marked departure from past bitcoin bull cycles, the latest market upswing has not translated into pricing power for ASIC manufacturers. Instead, the balance of power appears to be tilting toward bitcoin miners, who are now securing hardware deals on more favorable terms—including discounted BTC payments and embedded financial options—despite BTC surpassing the $100,000 mark.

Recent transactions by major public mining companies illustrate this reversal, suggesting a more cautious and disciplined capital environment among mining firms and signaling weak demand for hardware expansion—even amid price strength.

Hut 8, CleanSpark, HIVE Strike Favorable Deals

In April 2025, CleanSpark exercised a previously negotiated purchase option to acquire 13,200 machines for roughly $76.6 million. The payment, made in 691 BTC, was structured at a 15% premium to spot price at the time—translating to a fair value of $66.8 million and a spot assumption of around $96,600 per BTC. The deal included an option for CleanSpark to repurchase the same amount of bitcoin at a fixed price of $110,900, effectively providing the miner with a BTC call option at a time of rising market prices. See the full story from TheMinerMag here.

Hut 8 similarly took advantage of flexible terms in its 30,000-unit Antminer S21+ deal with Bitmain. The company pledged 968 BTC—now worth over $100 million—but the implied cost per terahash remains around $15/TH/s, a significant discount relative to Bitmain’s advertised $21.5/TH/s price tag. Like CleanSpark’s deal, Hut 8 retained a redemption right, allowing it to buy back the pledged bitcoin within three months of shipment.

Additionally, HIVE said on Thursday that it pledged a portion of its bitcoin treasury at a market price of $87,000 to settle the purchase of new ASIC mining equipment while securing an option to repurchase the bitcoin at the same price.

During the quarter, HIVE strategically deployed a portion of its bitcoin treasury to acquire next-generation ASIC mining equipment through a special agreement. The Company pledged bitcoin to settle the purchase at a market price of US$87,000 per BTC and secured an option to repurchase the equivalent amount of bitcoin at the same price—allowing HIVE a unique opportunity to capture potential upside in BTC price appreciation.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

A Sharp Contrast to Bull Market Norms

These transactions stand in stark contrast to previous bull markets, where hardware prices surged far ahead of intrinsic value and miners routinely paid steep premiums. During the 2021 cycle, for example, Antminer S19 series machines were sold at more than 3x their initial launch price, with units changing hands for $80 to $100/TH/s as BTC broke past $60,000. At the time, spot delivery premiums and prepaid orders became standard, with miners frequently placing bulk orders months in advance without volume discounts or financial flexibility.

Even in late 2017 and early 2021, it was not uncommon for new-generation miners to fetch premiums of 2-4x over the prevailing launch price, especially when supply was constrained. Manufacturers often demanded full prepayment in USD or tether, and few if any options were offered for BTC payments—let alone discounted or option-like structures.

Capex Cutbacks Reshape Market Dynamics

Driving the shift is a broader contraction in capital spending. Data from TheMinerMag shows that aggregate net PP&E investments from eight major public mining companies fell to just $600 million in Q1 2025, down from $770 million in Q4 2024 and nearly $1 billion in previous quarters. Importantly, some of that capex has flowed into high-performance computing (HPC) and AI infrastructure, rather than traditional bitcoin mining buildout.

This reduction in hashrate-related capex reflects multiple pressures: a post-halving decline in hashprice, elevated network competition, and a more disciplined approach to growth amid volatile margins. As a result, hardware manufacturers, facing softening demand and rising inventory, are showing a new willingness to negotiate.

The Bottom Line

The CleanSpark, Hut 8 and HIVE deals signal a pivotal moment: Bitcoin mining hardware vendors are no longer commanding the premiums and prepayments that once defined bull market dynamics. Instead, the current cycle has seen well-capitalized miners wielding greater leverage—extracting discounted pricing, negotiating for optionality, and preserving BTC liquidity through creative structuring.

For ASIC manufacturers, the message is clear: in a market where hashprice compression is biting and miner capital discipline is rising, pricing power is no longer a given—even when Bitcoin is setting new highs.

Regulation News

Malaysia’s Largest Energy Firm Reports 300% Rise in Crypto-Linked Power Theft - Decrypt

Hardware and Infrastructure News

Bitdeer Ramps up Realized Bitcoin Hashrate by 67% with SEALMINERS - TheMinerMag

CleanSpark Buys Miners With Bitcoin in Sign of Shifting ASIC Market Power - TheMinerMag

Bitfarms Halts Bitcoin Mining in Argentina Amid Power Supply Suspension - TheMinerMag

HIVE Targets 18 EH/s with Bitcoin-Backed Miner Purchases - TheMinerMag

Corporate News

Core Scientific Announces Departure of Board Member Todd Becker - Link

IREN Challenges $100M US Tariff Reassessment Over Bitcoin Miner Imports - TheMinerMag

POW.RE Announces Strategic Acquisition of Block Green to Expand Bitcoin Financial Services - Link

Financial News

Bitcoin miners MARA and CleanSpark post higher Q1 revenues, but both lose money - The Block

Bitcoin Miner MARA Stock Surges Despite Earnings Miss as Analysts Applaud Cost Cutting - CoinDesk

TeraWulf Q1 loss widens amid rising costs, falling revenue - CoinTelegraph

Hut 8 reports $134m Q1 loss amid Trump-backed American Bitcoin focus - Data Center Dynamics

Trump-affiliated mining firm American Bitcoin to go public via merger with Gryphon Digital - The Block

Feature

Bitcoin OP_RETURN War Explained - The Mining Pod

A new trend is emerging among publicly listed bitcoin mining companies: more are starting to sell. According to TheMinerMag’s monthly tracking of 15 mining companies, preliminary data for April shows that firms are liquidating a larger share of their production—an apparent reversal from the accumulation strategies favored last year.

(TheMinerMag used to track 19 companies, but Stronghold got merged into Bitfarms, while Bit Digital, Argo, and Terawulf no longer issue monthly updates)

Thanks for reading Miner Weekly! Subscribe for free to receive new posts and support my work.

So far, eight companies have published their April production updates. Collectively, they sold about 70% of their mined bitcoin during the month—the highest sell-through ratio since January 2024.

Riot Platforms and CleanSpark notably changed course in April. Both had been holding almost 100% of their production in previous months. Riot ended that streak by selling slightly more than it mined during the month—over 100%—while CleanSpark liquidated approximately 65% of its BTC production. Both companies also recently entered into bitcoin-backed loan facilities to make use of their bitcoin reserves.

The uptick in bitcoin sales reflects tightening economics as hashprice remains at $50/PH/s. As more firms report April figures in the coming weeks, the extent of the shift away from accumulation (or “hodl”) could become even clearer.

Only three companies so far —MARA, Cango and BitFuFu—fully retained their mined bitcoin last month. In MARA’s case, the firm has continued to fund operations through equity markets rather than dipping into reserves. It filed for a new $2 billion at-the-market equity offering in March, reinforcing its commitment to a full hodl strategy. BitFuFu, on the other hand, had a small increase of 61 BTC, resulting from its proprietary mining and bitcoin inflow from cloud mining customers.

Cango’s situation is more nuanced. The company entered into a master loan agreement with Antalpha, pledging its mined bitcoin as collateral to borrow cash for hosting payments to Bitmain. Given Cango’s ongoing transformation into a mining proxy for Bitmain via Antalpha’s proposed takeover bid, following its divestiture from auto-financing operations, the loan deal amounts to an intercompany transaction. In effect, Bitmain/Antalpha is the one holding the bitcoin mined by Cango.

Hardware and Infrastructure News

Bitfarms Joins Peer Bitcoin Miners in Halting Hashrate Expansion, Citing HPC Focus - TheMinerMag

Cipher to Energzies 2.5 EH/s Bitcoin Hashrate as Texas Buildout Progress Accelerates - TheMinerMag

IREN Closes Gap with CleanSpark as Realized Bitcoin Hashrate Jumps 25% in April - TheMinerMag

Corporate News

CleanSpark Faces Local Pushback Over Proposed Bitcoin Mine in Tennessee - TheMinerMag

Tether May Invest $25M in Antalpha’s Bitcoin Mining IPO - TheMinerMag

Riot Sells Bitcoin Production for First Time in 15 Months - TheMinerMag

Synteq Digital Announces Acquisition of Crunchbits, Accelerating its Expansion into HPC Data Center Services - Link

Financial News

Bit Digital Eyes $500M ATM as Bitcoin Mining Economics Tighten - TheMinerMag

Benchmark calls Canaan a ‘potent long-term play’ in bitcoin mining, sets $3 price target - The Block

Feature

Spain and Portugal blackout blamed on solar power dependency - FT

If you have been in crypto since 2021, you may remember Elon Musk abruptly suspending bitcoin payments for Tesla vehicles during the last bull market. The world’s richest man had just helped push BTC into the mainstream, only to reverse course weeks later, citing environmental concerns.

“We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions,” he posted at the time, “especially coal.”

That single tweet wiped off 5% of bitcoin’s market cap and kicked off a global reckoning about the environmental footprint of proof-of-work mining.

Fast-forward to 2025: the conversation has changed — and so has the data.

This week, the Cambridge Centre for Alternative Finance (CCAF) released its Digital Mining Industry Report. This comprehensive study gives the most credible picture yet of where bitcoin mining stands today. The headline stat? 52.4% of the electricity consumed by surveyed bitcoin miners now comes from sustainable sources — including hydro, wind, solar, and nuclear.

That figure isn’t just a nice round number — it’s based on survey responses and operational data from miners responsible for nearly half of the global bitcoin hashrate. It’s also a marked improvement from the last few years, as the industry has steadily moved away from coal-reliant regions and into areas with cheap, clean power, thanks to the prolonged bear market consolidation.

Thanks for reading Miner Weekly! Subscribe for free and support our work.

And it’s not just about optics. Energy costs now make up 80% of miners’ total operational expenses, according to the report, so the shift toward renewable energy isn’t just environmental — it’s financial survival. As competition and electricity prices rise, miners are flocking to regions with abundant, low-cost renewables, like Texas, Quebec, Ethiopia, and Oman. Meanwhile, locations like Kazakhstan, once a booming mining hub, have sharply declined due to regulatory crackdowns and power price hikes.

The CCAF report also highlights how mining is becoming more institutionalized, with greater professionalization, consolidation, and diversification into areas like high-performance computing and AI hosting. But the sustainability shift stands out as a critical milestone — not just for the industry, but for its critics.

Of course, it’s not all perfect. The report acknowledges that verification of renewable claims is still inconsistent, and not all miners are equally transparent about their energy sources. Still, the direction is clear: greener, leaner, and more resilient.

So Elon, if you’re reading:

Bitcoin mining is now majority green, at least by this data. Are we good to pay for Teslas in BTC again?

Regulation News

Bitcoin mining syndicate busted in Terengganu for electricity theft worth RM36,000 monthly - Malay Mail

Hardware and Infrastructure News

Compass Energizes 8MW of New Proprietary Bitcoin Mine in Iowa - TheMinerMag

CleanSpark Eyes Bitcoin Mining Expansion in Mountain City, Tennessee - TheMinerMag

Phoenix Group Expands Bitcoin Mining in Ethiopia to 132 MW - TheMinerMag

Bitcoin Miners Turn to Renewables as Industry Matures: Cambridge Report - TheMinerMag

The SlickFracking-Powered Crypto Mine in Pennsylvania Shuts Down Without Word to Regulators - Capital and Main

Bitcoin Mining Difficulty Set for Largest Drop Since December 2022 - TheMinerMag

Corporate News

Digi X Power, formerly Digihost, plans Bitcoin mining site in Burke County. Town to consider restrictions - Hickory Record

Galaxy Expands CoreWeave Deal, Accelerates Shift From Bitcoin Mining to AI Hosting - TheMinerMag

Financial News

Bitcoin Miner 1Q Results May Disappoint as Hashprice Fell, Tariffs Hit: CoinShares

AI Startup Nscale Chases ByteDance Deal and $1.8 Billion in Debt - Bloomberg

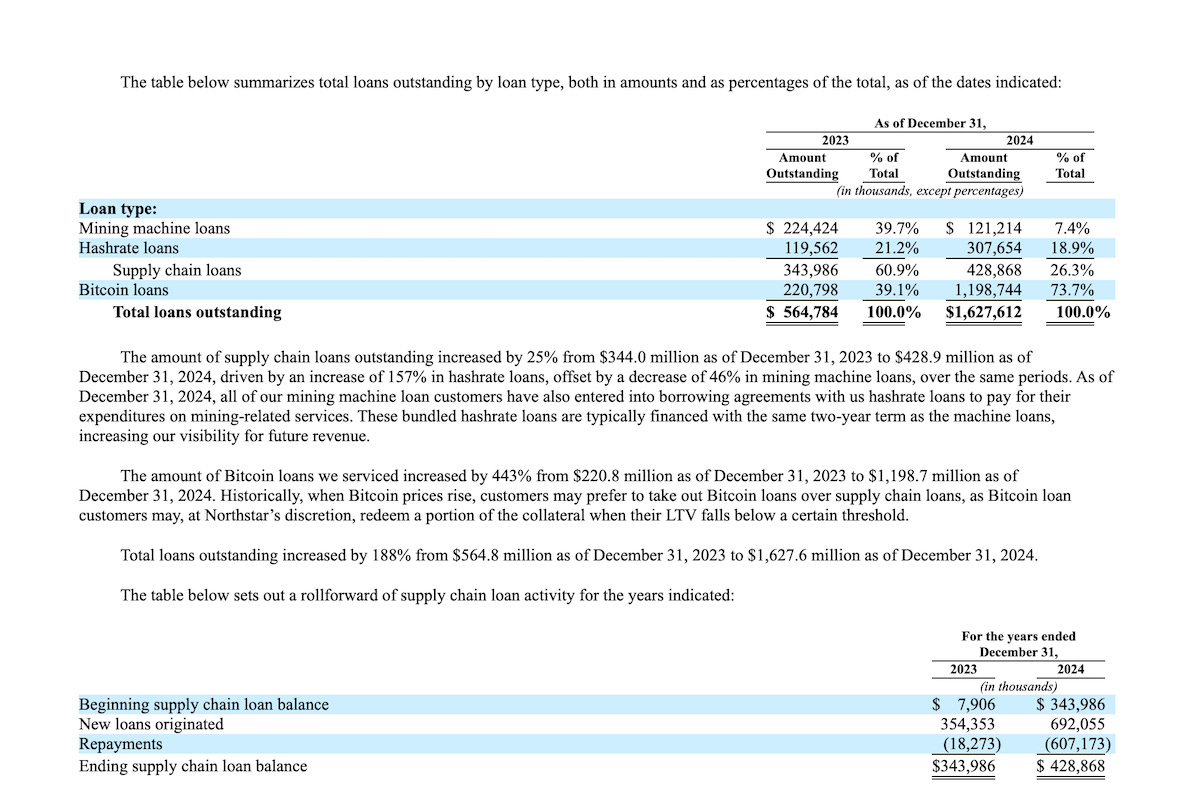

Bitmain’s financing arm, Antalpha, filed for an initial public offering in the U.S. this week. While the target raise of $50 million and its modest $47 million in 2024 revenue may not make major waves, the prospectus reveals compelling details about the company’s lending business, particularly its role in servicing bitcoin miners and the growing investor demand in Asia.

Antalpha operates a dual-pronged lending model tailored to the digital asset mining industry. It offers both bitcoin-backed loans and supply chain financing, including loans secured by mining hardware or hashrate. These two product lines serve distinct but complementary purposes, enabling mining companies to access liquidity while optimizing capital efficiency.

Bitcoin Loans

Bitcoin loans are facilitated through Antalpha’s platform, Antalpha Prime, in partnership with external financing providers, most notably Northstar. In this arrangement, Antalpha acts as a service provider, helping customers obtain capital using bitcoin as collateral without assuming credit risk on its own balance sheet. Borrowers typically pledge bitcoin, which is held as security for the duration of the loan.

These loans surged in 2024. Antalpha ended the year with $1.2 billion in bitcoin loans outstanding—more than five times the previous year’s total—and originated $1.23 billion in new loans during the year. The growth reflects strong institutional demand for crypto-backed credit, particularly across Asia.

But who is Northstar, the key financing partner behind these loans? Antalpha and Northstar were initially sister companies under a shared parent entity ultimately controlled by Bitmain co-founder Ketuan Zhan. This corporate connection made Bitmain a foundational partner in developing Antalpha’s bitcoin loan servicing business.

Thanks for reading Miner Weekly! Subscribe for free and support our work.